IWS Management Process

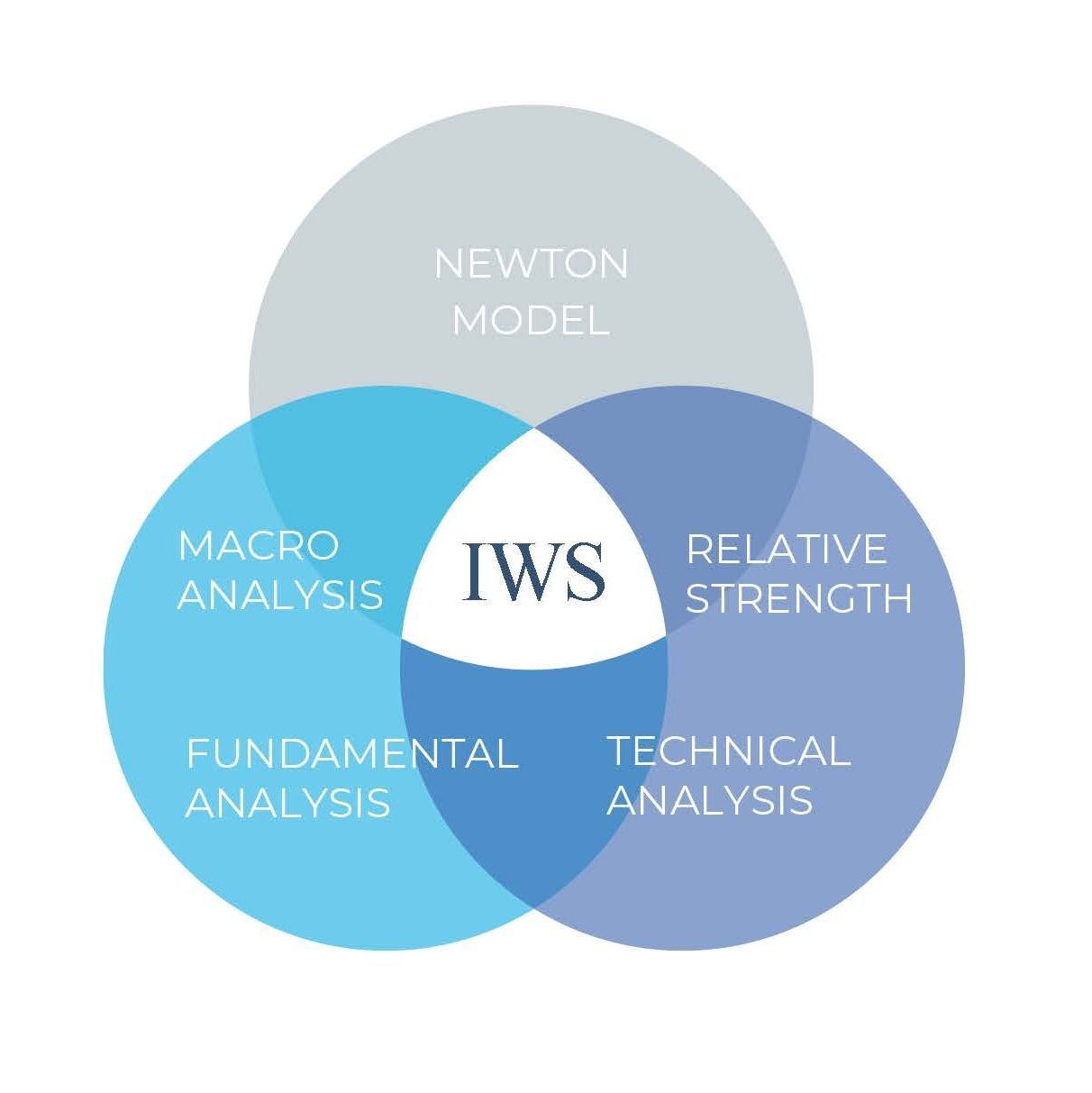

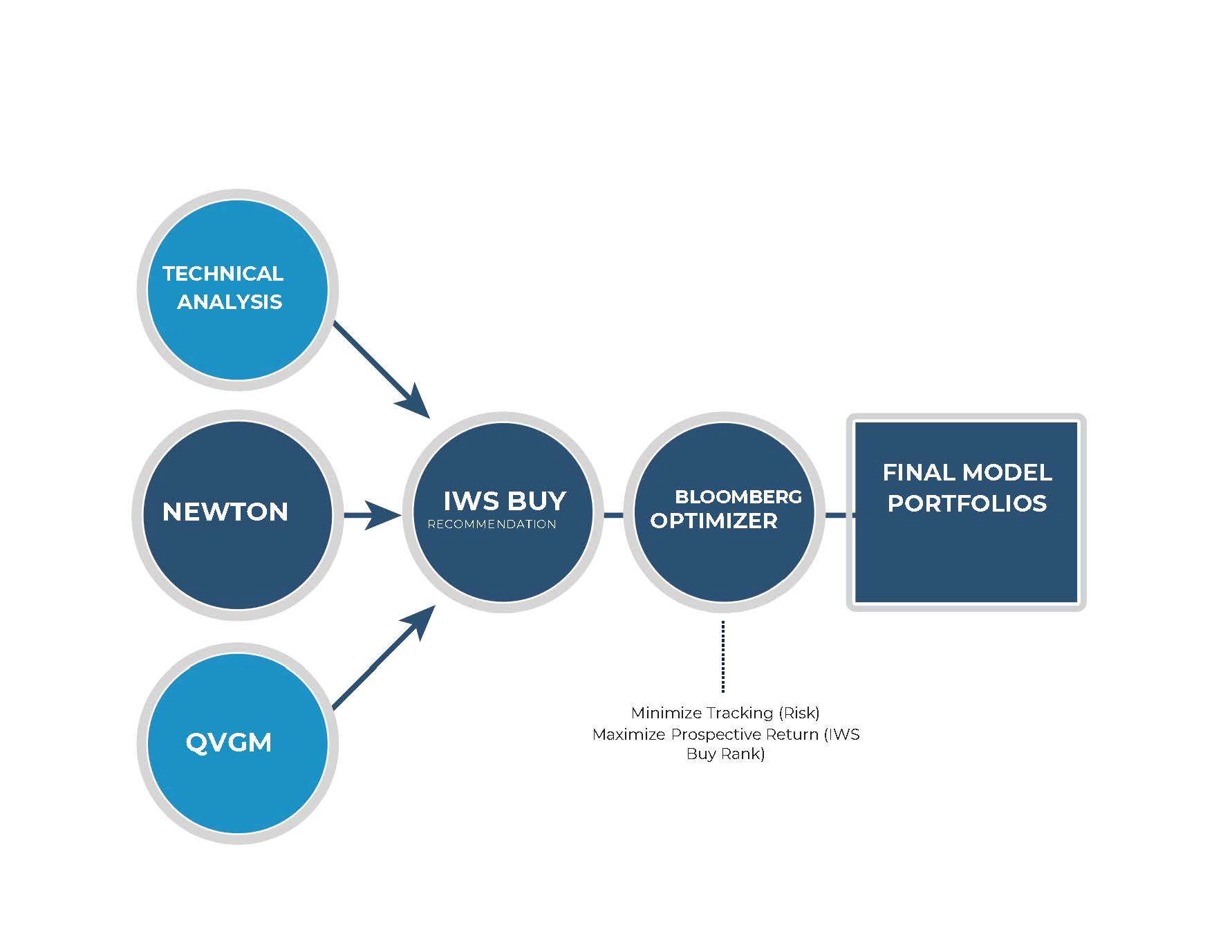

IWS merges fundamental and technical analysis with cutting-edge predictive analytics to make better investment decisions.

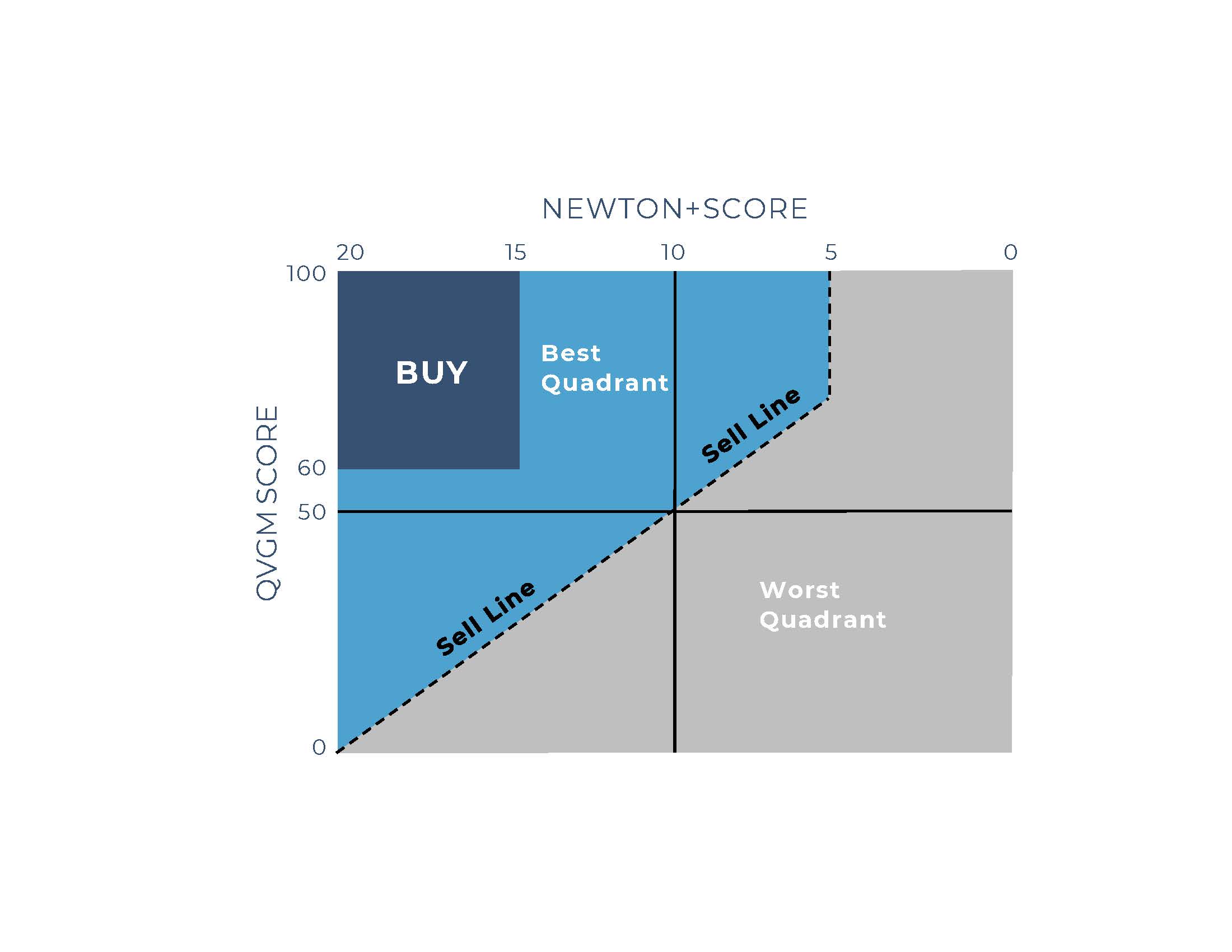

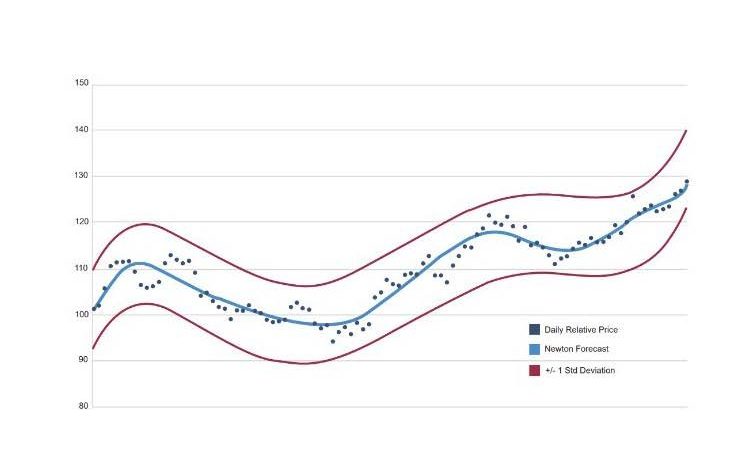

Investment Process Newton Model

Newton is a proprietary quantitative model that employs advanced algorithmic techniques to identify future price trends based upon historical data and current market conditions.

Newton tracks thousands of stocks and ETF’s, which comprise our investable universe, across multiple performance time periods and scores them on a scale of 0 to 20.

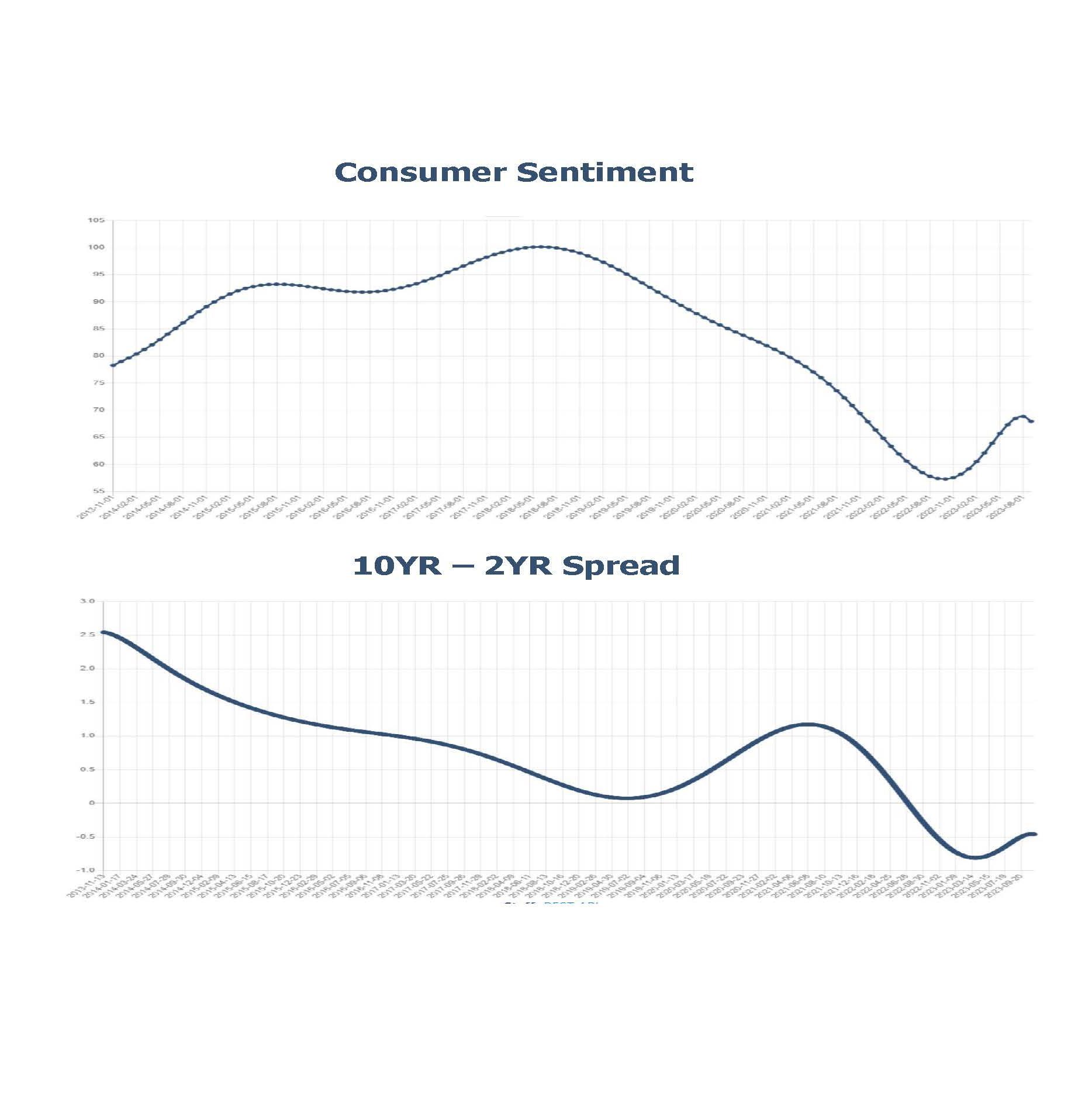

Investment Process Macro Analysis

The IWS investment team synthesizes current and historical economic and market environments to develop a top-down framework for managing portfolios in-line with today’s investment landscape.

Daily discussions and weekly investment calls ensure the team remains informed on market action as they analyze the latest economic data releases and Wall Street events.

The development of these market views informs our analysis of countries, sectors, industries, and styles for opportunistic rotation to attractive areas of investment.

Investment Process Technical Analysis

The IWS investment team leverages their expertise in analyzing price data to identify trends, determine entry and exit points, and remain in-tune with fluctuations in markets.

The team utilizes a wide range of indicators, such as relative strength, volume, momentum, volatility measures, and custom proprietary scans.

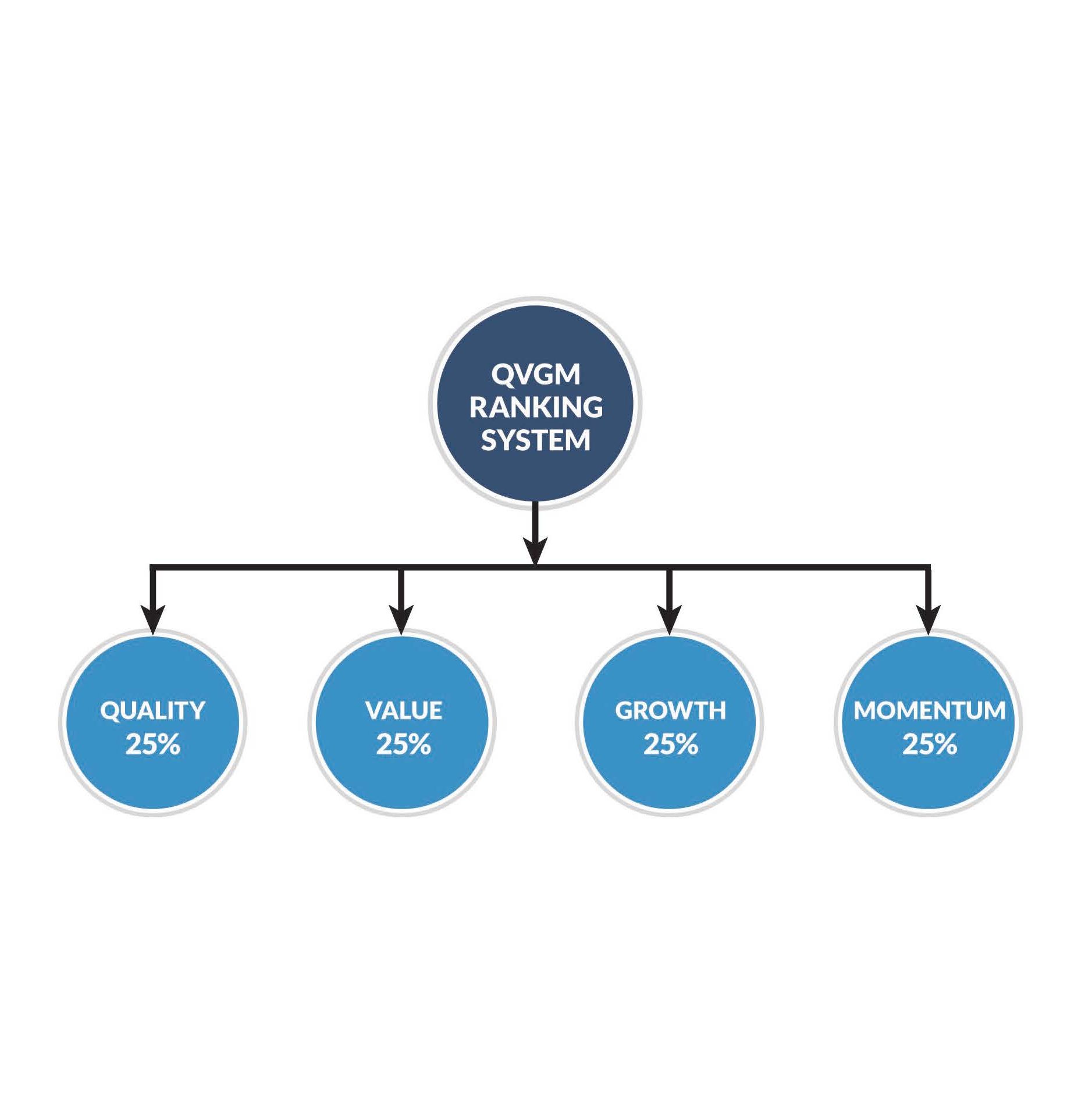

Investment Process QVGM System

Quality. Value. Growth. Momentum.

Our stock selection process incorporates a sophisticated four factor fundamental rating of companies in our 3,000+ stock universe.

IWS can place nuanced emphasis on selected factors, enhancing the alignment of the QVGM score with specific investment strategies.

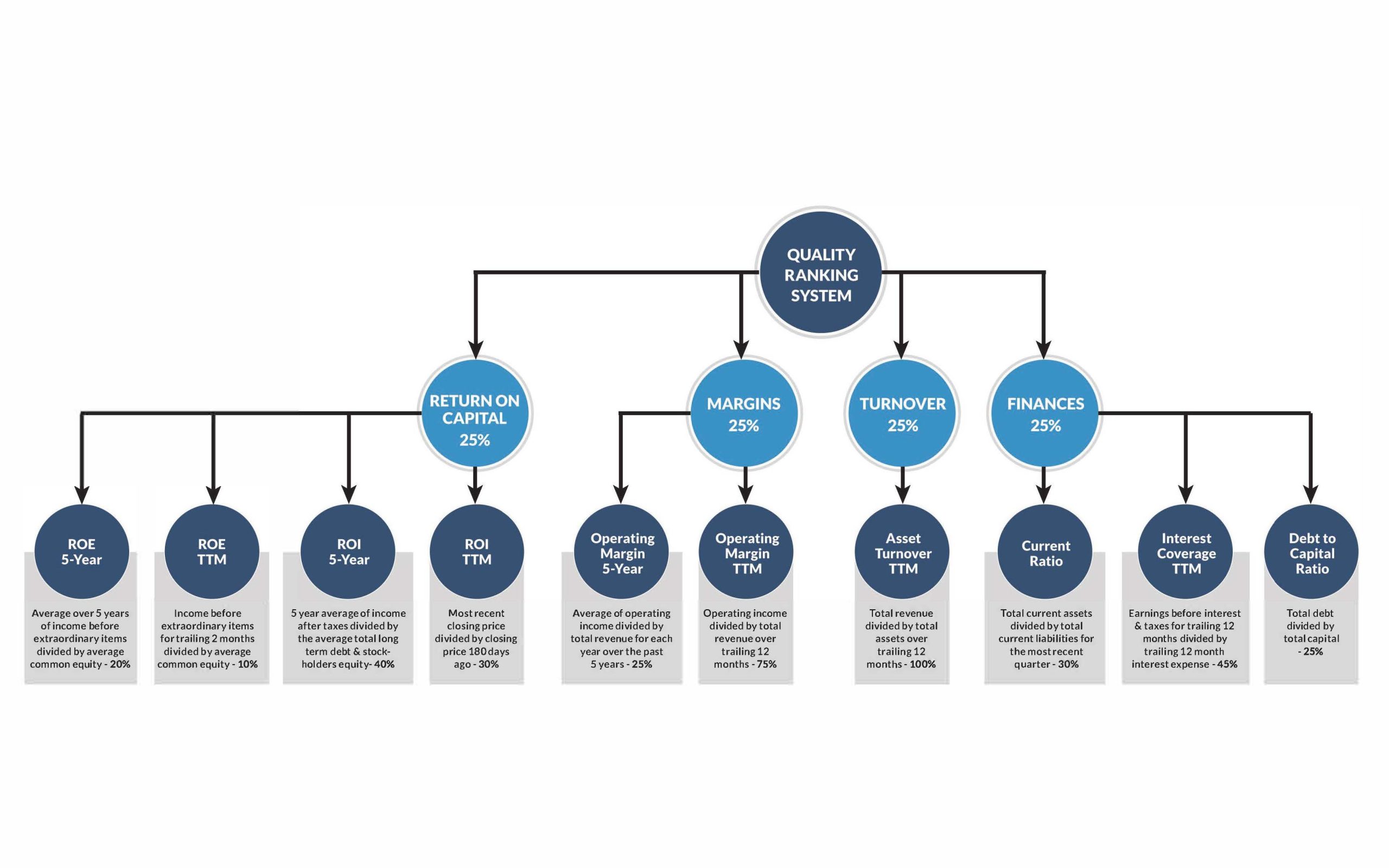

Quality Ranking System

Gauges how well the company is managed.

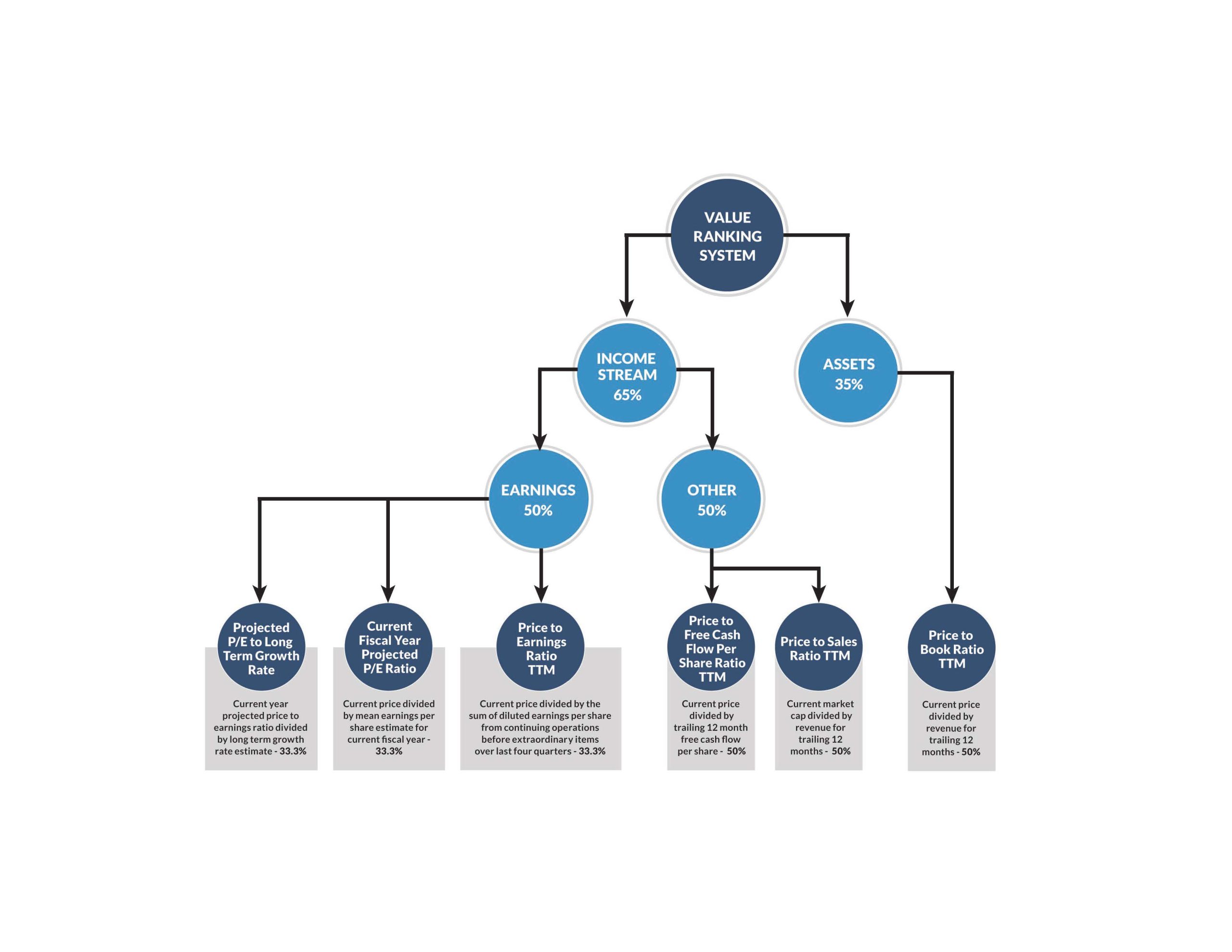

Value Ranking System

Gauges how well a stock is priced compared to the company’s earnings.

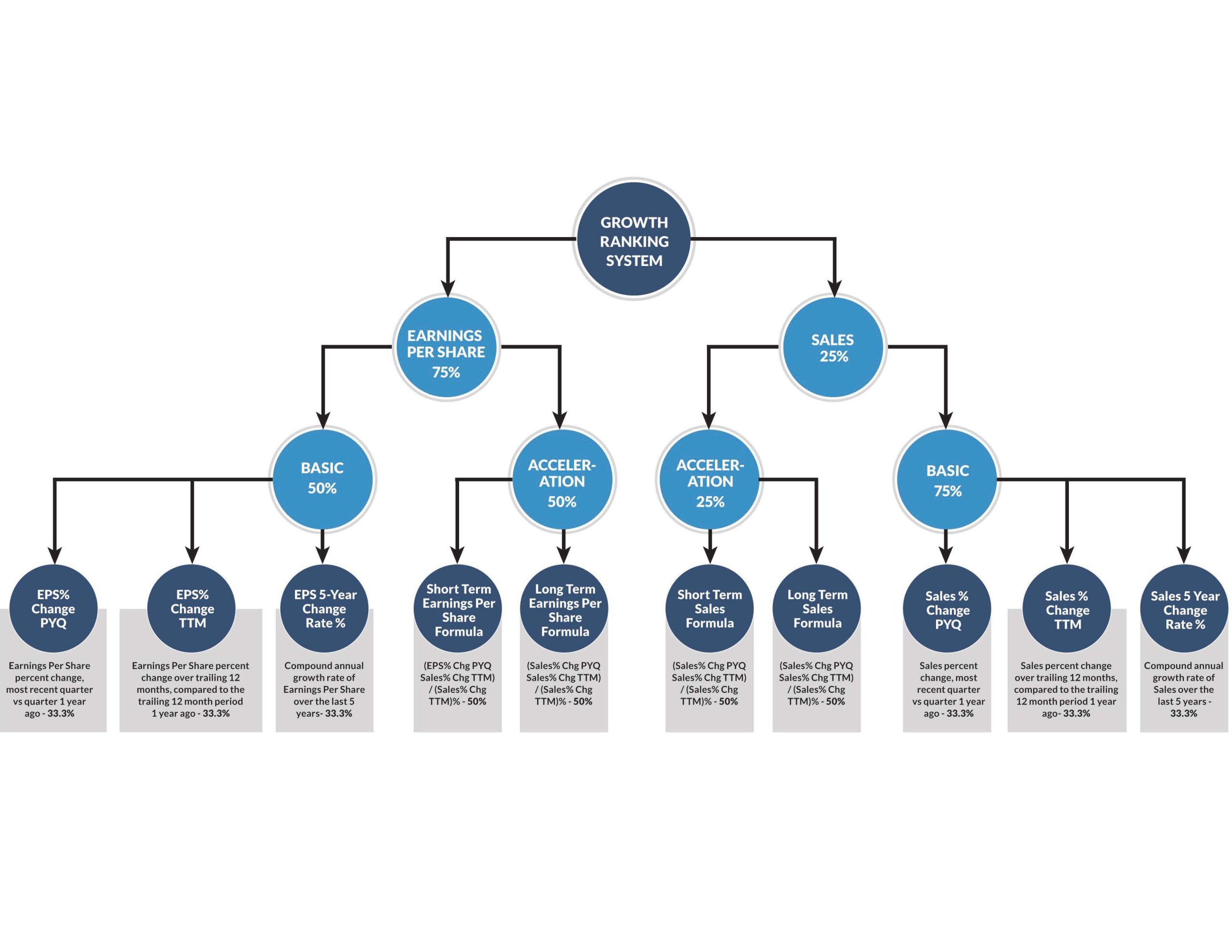

Growth Ranking System

Measures earnings growth relative to the market.

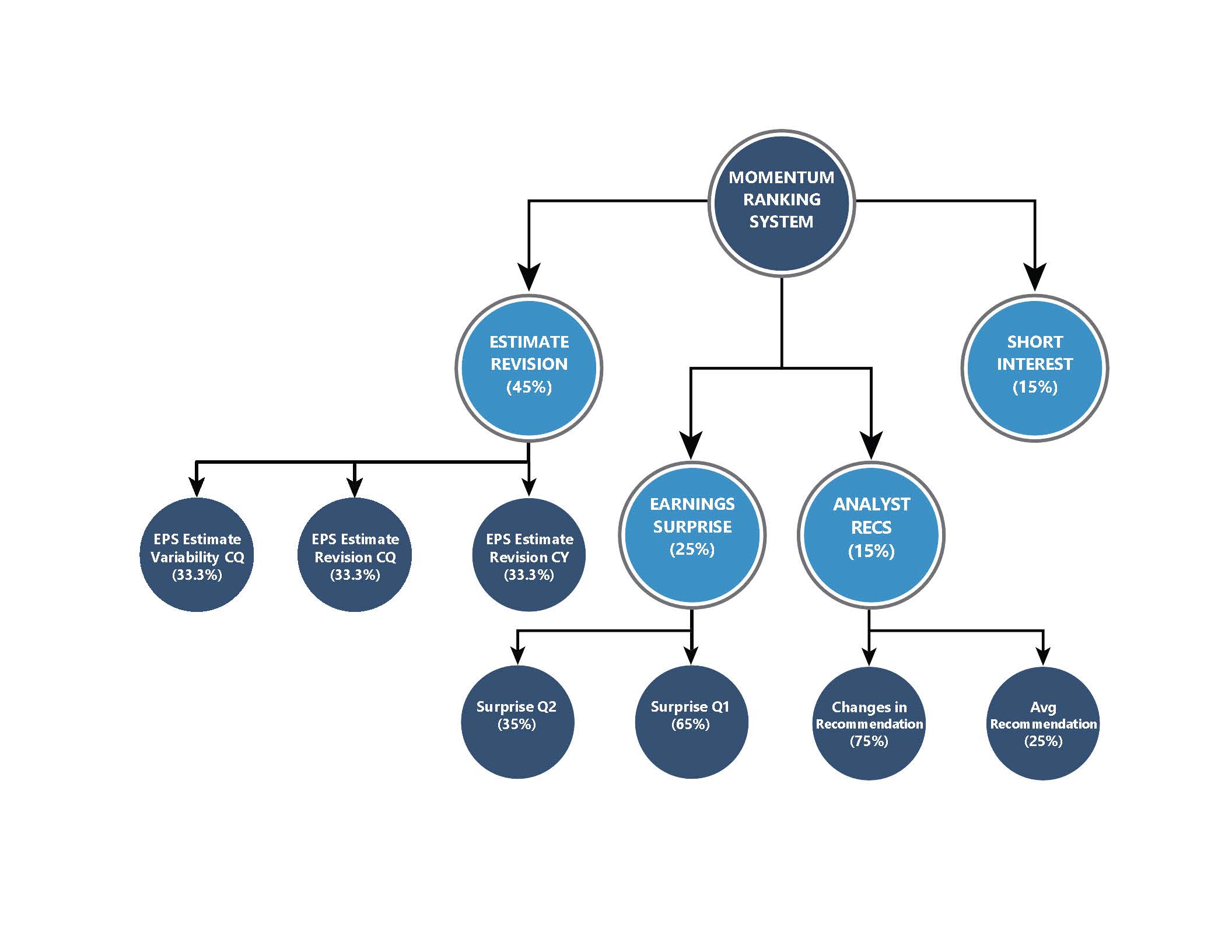

Momentum Ranking System

Determines if the price movements of a stock are currently trending upward. Psychology is an important factor in markets, and trends tend to continue until something disrupts them.

Investment Process Discipline

The optimization process is designed to reduce active risk and maximize the overall weighted QVGM, Newton, and Alpha scores of the portfolio.

The process focuses on constantly improving our overall portfolio score versus our benchmark.